Commonwealth Bank you can do better!!! CBA is not hassle Free 2011

Commonwealth Bank you can do better

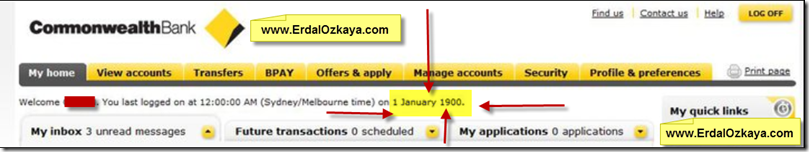

Sometimes a picture is worth 1000 words, and the below example is perfect for this “saying”! What do you think 🙂

More About Commonwealth Bank

Australia’s oldest and as you can see from the screen shot “worst” bank , but also the biggest

Please browse social media and see how they just “can’t do it”

Here is Twitter :

Same applies at LinkedIn, Facebook and other just search

Image Credit

Also in the news

From Their web site

The Commonwealth Bank was founded under the Commonwealth Bank Act in 1911 and commenced operations in 1912, empowered to conduct both savings and general banking business. Today, we’ve grown to a business with more than 800,000 shareholders and 52,000 people working in the Commonwealth Bank Group. We offer a full range of financial services to help all Australians build and manage their finances.

First Sydney branch

“Precisely at 10 o’clock yesterday morning, the doors of the Commonwealth Savings Bank in Moore Street were thrown open for business in the presence of a large number of spectators, including the Prime Minister Andrew Fisher.”

– The Sydney Morning Herald Monday 13 January 1913

Amalgamations

The Group has been involved in many mergers. Some pre-date the establishment of the Commonwealth Bank itself.

SO what is CBA ( From Wikipedia)

The Commonwealth Bank of Australia (CBA), or CommBank, is an Australian multinational bank with businesses across New Zealand, Asia, the United States and the United Kingdom. It provides a variety of financial services including retail, business and institutional banking, funds management, superannuation, insurance, investment and broking services.

The Commonwealth Bank is the largest Australian listed company on the Australian Securities Exchange as of August 2015 with brands including Bankwest, Colonial First State Investments, ASB Bank (New Zealand), Commonwealth Securities (CommSec) and Commonwealth Insurance (CommInsure).

Its former constituent parts were the Commonwealth Trading Bank of Australia, the Commonwealth Savings Bank of Australia, and the Commonwealth Development Bank.

Founded in 1911 by the Australian Government and fully privatised in 1996, the Commonwealth Bank is one of the “big four” Australian banks, with the National Australia Bank (NAB), ANZ and Westpac. The bank was listed on the Australian Stock Exchange in 1991.

To read more

Commonwealth Bank of Australia. Group Archives.

The Group Archives serves our internal needs and supplies information to the public about the organisation’s history and operations.

The centre houses information about the Commonwealth Bank and other financial institutions whose archives have come to us as a result of amalgamations (including Colonial Mutual Limited and the Rural Bank of New South Wales).

Sources of information include:

- Annual reports and other publications (including brochures, posters and advertising materials)

- Records about the Commonwealth Bank’s current and former properties

- Records about our organisational structure and staffing

- Photographs of people, events and buildings

- Ledgers, registers and commercial records

- Memorabilia including currency, uniforms, furniture, safes, moneyboxes and gold scales

- An archive of employee magazines, corporate history files, terms and conditions, product disclosure statements and circulars

- Film, video, and other fragile audio-visual materials

You can contact the centre by email [email protected]

By prior arrangement, appointments can be made to consult some materials on site.

Commonwealth Bank of Australia. Group Archives. CommBank

133-141 Liverpool Street, Sydney NSW 2000

1991 – 2003

1991

Privatisation of the Commonwealth Bank of Australia commences (completed in 1996).

1993

The Commonwealth Bank’s first customer service contact centre opens in Brisbane, followed in March 1994 by a new contact centre in Sydney with a new telephone number – 13 2221.

1995

General insurance established under Commonwealth Connect Insurance Limited (CCIL).

A new stockbroking company is established, Commonwealth Securities Limited, later known as CommSec.

The Commonwealth Bank website www.commbank.com.au is launched

1997

NetBank launched, offering 24-hour internet transaction banking services – a first among the majors in Australian banking. In the same year, BPay, a national electronic bill paying service, commences.

2000

The Commonwealth Bank acquires Colonial Limited.

International Financial Services (IFS) established to unite offshore operations.

2003

The Commonwealth Bank Foundation established to improve the financial literacy of young people and Aboriginal and Torres Strait Islanders.

2004 – 2011

2004

Private Bank is launched.

2007

The Commonwealth Bank acquires Bank Arta Niaga Kencana, doubling the staff and retail branch network of PT Bank Commonwealth, Indonesia.

The Start Smart Program launches to provide financial literacy classes to school students for a basic understanding of how to build children’s financial literacy skills.

2008

The Commonwealth Bank acquires Bankwest.

The Commonwealth Bank opens a branch in Ho Chi Minh City, Vietnam and buys a 15 per cent stake in the Vietnam International Bank in 2010.

2009

The Commonwealth Bank Indigenous Banking Team launched as part of the Group’s Reconciliation Action Plan: a first for Australian banking.

2010

Expansion into Asia continues, illustrated by joint ventures with two Chinese banks, the Jinan City Commercial Bank (now Qilu Bank) and Bank of Hangzhou. Shanghai and Mumbai (India) branches opened.

2011

The Commonwealth Bank announces a $100 million increase in community investment over the next 10 years.

Completing the Remedial Action Plan

Three years ago, we set about improving governance, culture and accountability across the bank by implementing all of the recommendations in the Prudential Inquiry final report.

Completing the RAP is a significant milestone but we recognise there is still much more for us to do.

Our focus is to now demonstrate that the changes we’ve made are sustained and continuously improved.

A roadmap for change

In May 2018, APRA’s Prudential Inquiry released a report outlining shortcomings in governance, culture and accountability at the Commonwealth Bank (CBA). The report was constructive and fair and we accepted all of the 35 recommendations. We have now addressed all recommendations in full.

APRA endorsed CBA’s comprehensive Remedial Action Plan in June 2018. The plan outlined the actions we would take to improve risk management capability and deliver better outcomes for our customers.

Prudential Inquiry report

APRA released the report from its Prudential Inquiry into the bank’s governance, culture and accountability in May 2018. Read APRA’s Prudential Inquiry report in full.